#PakistanIssues #TerrorismEradication #PovertyAlleviation #TaxCompliance

Unveiling Pakistan's Challenges: A Collective Quest for Solutions

Introduction

In the diverse tapestry of Pakistan's rich culture lies a nation facing significant challenges: terrorism, poverty, and tax evasion. This article delves into these issues, intricately woven into the social, economic, and political fabric, advocating for a united approach from government, civil society, and citizens.

Terrorism: A Scourge on Society

The ominous presence of terrorism looms large over Pakistan, disrupting daily life and impeding progress. Extremist groups exploiting religious sentiments have sown violence, resulting in tragic loss and pervasive fear. Combating this menace requires a multifaceted strategy addressing root causes like poverty, lack of education, and societal marginalization.

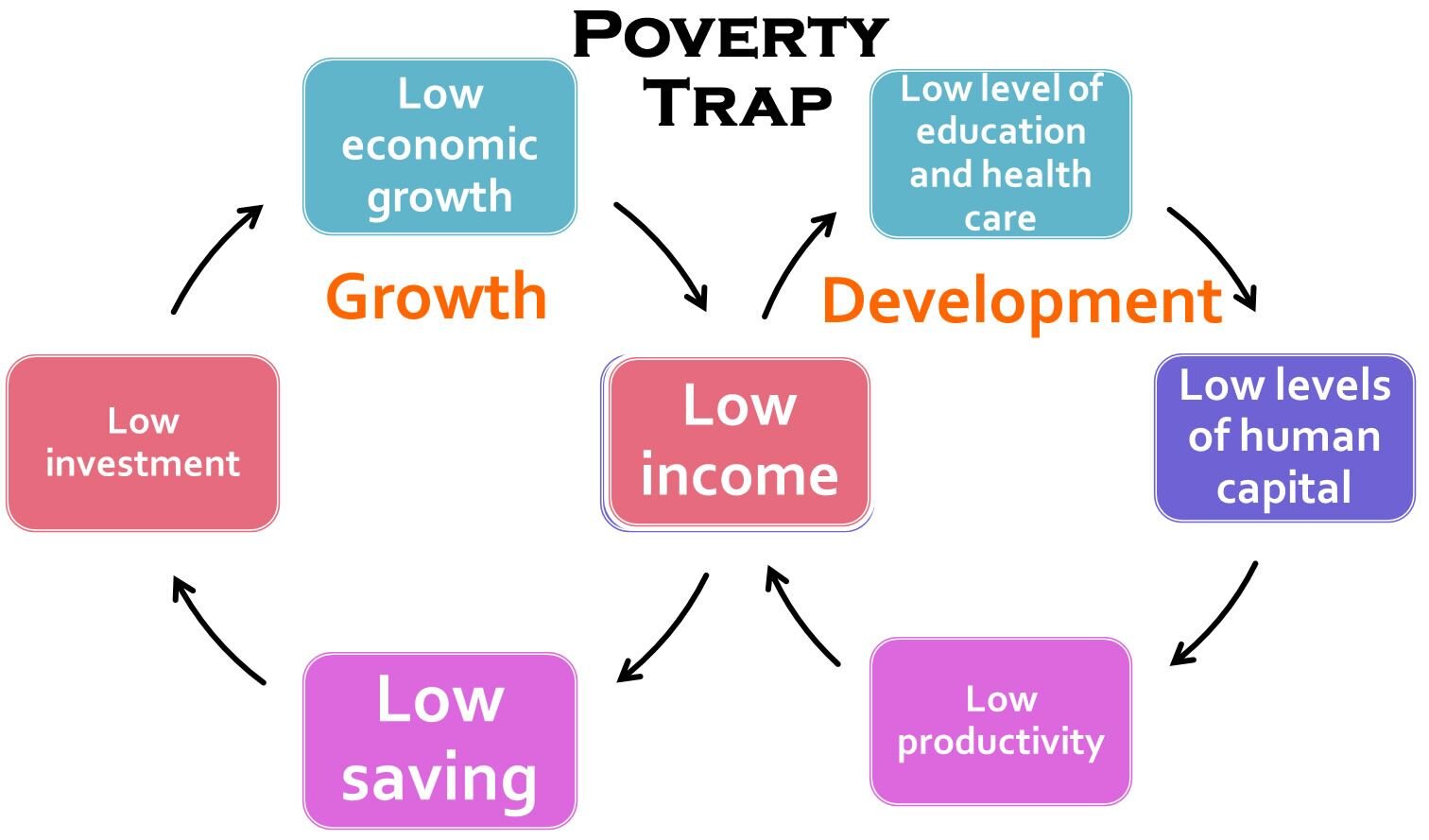

Poverty: A Persistent Struggle

The clutches of poverty stifle Pakistan's development, ensnaring a substantial part of the population in a cycle of deprivation. Soaring costs of essentials, coupled with unemployment and insufficient social safety nets, worsen the plight of the poor. A holistic approach prioritizing economic growth, job creation, and fair resource distribution is essential to address this complex challenge.

Tax Evasion: A Drain on Resources

Widespread tax evasion undermines Pakistan's fiscal health, depriving the government of vital revenue for essential services. This culture of non-compliance stems from distrust in institutions, complex tax laws, and fear of severe penalties. Expanding the tax net requires simplifying procedures, enhancing transparency, and raising public awareness of civic duties.

The Road to Resilience: A Collective Endeavor

Addressing Pakistan's multifaceted challenges necessitates a collective effort transcending political divides. Inclusive dialogue, tolerance promotion, and investments in education and social development can pave the way for a more peaceful, prosperous, and equitable society.

Conclusion: A Beacon of Hope

Despite its challenges, Pakistan possesses immense potential to emerge as a beacon of stability and prosperity. Embracing collaboration, prioritizing citizen well-being, and implementing effective governance strategies can help overcome hurdles and steer the nation towards a brighter future.

Additional Insights

- Religious scholars play a crucial role in promoting tolerance and countering extremism.

- Technological advancements in tax administration can streamline processes and enhance compliance.

- Empowering women and marginalized groups can contribute to societal progress.

A Call to Action

Every Pakistani bears the responsibility to contribute to a better future. Engaging in civic discourse, demanding accountability, and upholding ethical values can collectively shape a more resilient and prosperous Pakistan.

In addition to economic and political instability, terrorism remains a top concern. Addressing this issue requires a unified effort to discourage extremism and promote peace. The recent meeting between religious scholars and the Army Chief emphasizes the importance of a united front against intolerance, extremism, and terrorism. It underscores Pakistan's commitment to peace and the need for Afghanistan to take serious steps to address terrorism emanating from its soil.

Overcoming Poverty and Economic Challenges

Hunger, poverty, and unemployment pose significant threats to any society, including developed countries. In Pakistan, the increasing poverty rate demands urgent attention. Inflation, driven by rising prices of essential commodities, further exacerbates the situation. To uplift those below the poverty line, a shift towards small industries and private businesses is crucial. This not only benefits the economy but also liberates people from the shackles of poverty.

Government Initiatives for Tax Collection

The Federal Board of Revenue (FBR) aims to bring 1.5 to 2 million new taxpayers into the system by June 2024. This initiative involves district officers collecting income tax from non-filers and halting utility services for non-compliance. The government's push for automatic data transmission from various departments to the FBR is a positive step to expand the tax net. With only 33% of the tax-paying class included after 76 years, this initiative is crucial for economic stability.

Challenges and the Way Forward

To salvage the national economy and eliminate foreign debts, fostering healthy economic activities and embracing automated systems are imperative. Investors need a conducive environment to invest, and a corruption-free system is vital. This collective effort, addressing issues at their roots and promoting transparency, is the key to a prosperous and resilient Pakistan.