Navigate the complexities of sending money to Pakistan with this comprehensive guide, exploring various transfer methods, fees, and strategies to ensure safe and efficient transactions.

#moneytransferpakistan #remittancepakistan #onlinemoneytransferpakistan #safemoneytransferpakistan #moneytransferservicespakistan

Introduction: The Significance of Money Transfers to Pakistan

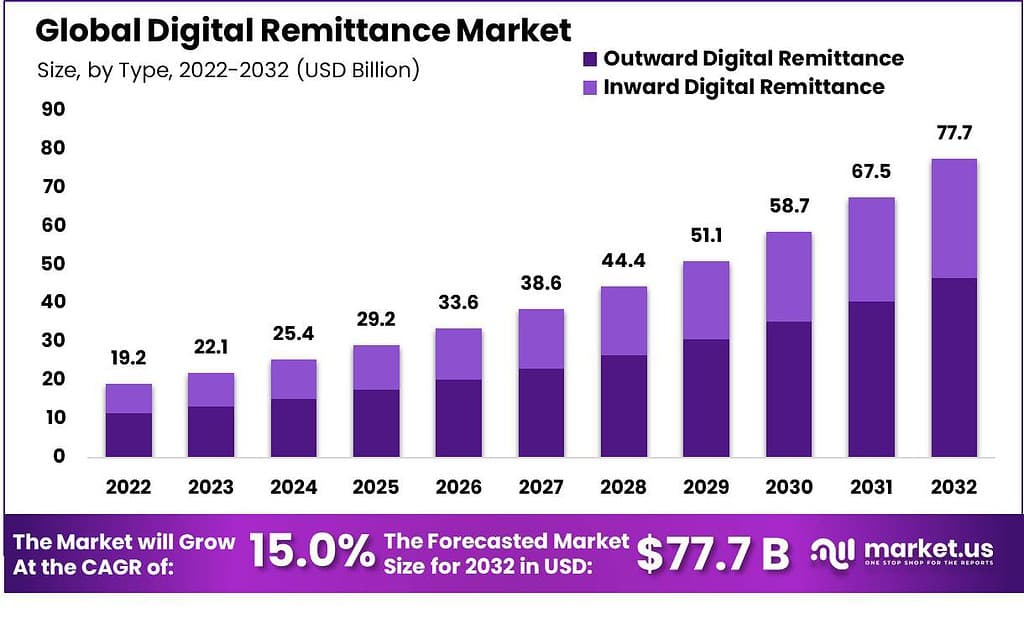

Remittances play a vital role in the Pakistani economy, accounting for a significant portion of the country's external financing. These funds, sent primarily by overseas Pakistanis to their families and friends, contribute to poverty reduction, economic growth, and overall financial stability in Pakistan.

Navigating the Money Transfer Landscape: Understanding the Options

Individuals seeking to send money to Pakistan face a plethora of options, each with its own set of advantages and disadvantages. Understanding these options is crucial for making informed decisions and ensuring a seamless transfer process.

Traditional Bank Transfers: A Tried-and-Tested Approach

Traditional bank transfers offer a familiar and secure method for sending money to Pakistan. However, fees associated with traditional bank transfers can be relatively high, often including transaction fees, currency exchange fees, and correspondent bank fees.

Money Transfer Specialists: Convenience and Speed at a Premium

Money transfer specialists, such as Western Union and MoneyGram, provide a convenient and often faster alternative to traditional bank transfers. These services typically offer competitive exchange rates and may provide options for cash pickup or direct bank deposits in Pakistan.

Online Money Transfer Services: Disrupting the Remittance Landscape

Online money transfer services, such as Wise and Remitly, have revolutionized the remittance industry by offering lower fees, more transparent pricing, and user-friendly online platforms. These services often utilize mid-market exchange rates, significantly reducing the cost of transfers compared to traditional banks.

Factors Influencing Transfer Costs: Understanding the Economics

Several factors influence the cost of sending money to Pakistan, including:

Transfer Amount: Larger transfer amounts typically incur lower fees per unit of currency.

Transfer Method: Money transfer specialists often offer lower fees than traditional banks, while online money transfer services may provide the most cost-effective options.

Currency Exchange Rates: Fluctuations in exchange rates can impact the overall cost of transfers. Timing transfers strategically, when the Pakistani rupee is relatively weak against the sending currency, can minimize costs.

Payment Method: Paying for transfers via bank accounts or debit cards typically incurs lower fees compared to using credit cards or cash payments.

Optimizing Transfers for Maximum Efficiency

To optimize money transfers to Pakistan and minimize costs, consider these strategies:

Compare Fees and Exchange Rates: Carefully compare fees and exchange rates offered by different providers to find the most cost-effective option.

Consider Transfer Speed and Convenience: Balance the speed of transfer with the associated fees. Faster transfer options may incur higher costs, while slower methods may be more economical.

Utilize Online Platforms for Transparency: Online money transfer services offer transparent pricing and real-time exchange rate updates, facilitating informed decisions.

Explore Promotions and Bonus Offers: Some providers may offer promotions or bonus deals for new customers or larger transfer amounts.

Educate Recipients about Receiving Options: Inform recipients about various receiving options, such as cash pickup, bank deposits, or mobile wallets, to select the most convenient method.

Conclusion: Empowering Financial Connections with Pakistan

In conclusion, navigating the intricate landscape of sending money to Pakistan requires a blend of informed decision-making and strategic planning. By delving into the diverse options available, understanding the factors influencing transfer costs, and adopting optimization strategies, individuals can not only streamline the process but also foster stronger financial connections with their loved ones in Pakistan.

As the global financial landscape continues to evolve, staying abreast of emerging technologies and trends will further empower individuals in their quest for seamless money transfers. Whether opting for traditional bank transfers, reliable money transfer specialists, or the convenience of online platforms, the key lies in making choices that align with both speed and cost-effectiveness.

In the realm of international transactions, sending money to Pakistan can transcend the mundane act of financial exchange; it becomes a powerful tool for fostering economic growth, reducing poverty, and strengthening familial ties. As you embark on your journey of financial connectivity, armed with the insights from this comprehensive guide, may your money transfers be not just transactions but pathways to prosperity and shared well-being.

Sending money to Pakistan can be a straightforward and efficient process when armed with the right knowledge and strategies. By understanding the various transfer options, comparing fees and exchange rates, and utilizing online platforms for transparency, individuals can optimize their transfers and maintain strong financial connections with their loved ones in Pakistan.