The Truth About Taxes: Understanding the American Tax Burden

Examining the American Tax Burden with Historical, Political, and International Context

Introduction

The topic of taxation often evokes strong emotions, especially around tax season. In this article, we delve into the complexities of the American tax system, examining its history, political context, and international comparisons. We also explore how wars and conflicts influence tax policies, and what lessons can be learned from global practices.

Historical Context of American Taxation

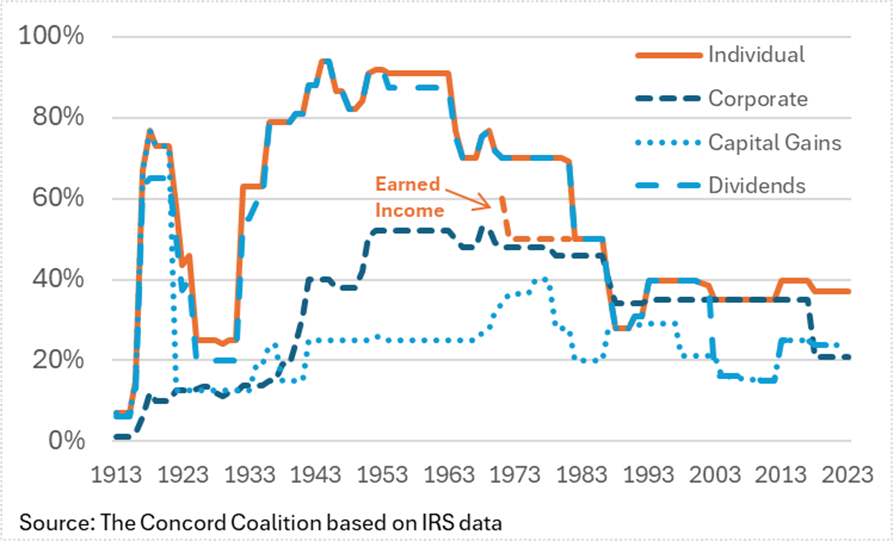

Taxation in the United States has evolved significantly since the colonial era. The infamous Stamp Act of 1765 imposed by the British Parliament ignited colonial outrage and contributed to the American Revolution. Post-independence, the U.S. Constitution granted Congress the power to levy taxes. The Revenue Act of 1861 introduced the first federal income tax to fund the Civil War, setting a precedent for future taxation during wartime.

Political Background

The American tax system has been a battleground for political ideologies. Republicans often advocate for lower taxes and reduced government spending, emphasizing economic growth through private sector investments. Key reforms include the Tax Cuts and Jobs Act of 2017, aimed at reducing corporate taxes and stimulating economic activity.

On the other hand, Democrats typically support progressive taxation to fund social programs and reduce income inequality. This approach has led to debates on the efficacy of tax policies in achieving economic justice and ensuring public welfare.

International Comparisons

Comparing the U.S. tax system with other nations reveals stark differences. Many countries with lower tax rates boast higher citizen satisfaction and robust economies. For example, nations like Singapore and Switzerland maintain competitive tax regimes, attracting businesses and fostering economic growth. In contrast, the U.S. grapples with one of the highest corporate tax rates, impacting its global competitiveness.

The Impact of War on Taxation

Wars and conflicts historically lead to increased taxation to fund military expenditures. The U.S. Civil War, World Wars I and II, and recent conflicts in the Middle East have all necessitated higher taxes. These fiscal demands often extend beyond the duration of conflicts, burdening future generations.

Government Efficiency and Public Trust

The efficiency of tax utilization is a perennial concern. Taxpayers expect their contributions to result in improved infrastructure, education, healthcare, and security. However, instances of government waste and misallocation of funds erode public trust. Ensuring transparency and accountability in tax spending is crucial for maintaining citizen confidence.

The Future of Tax Reform

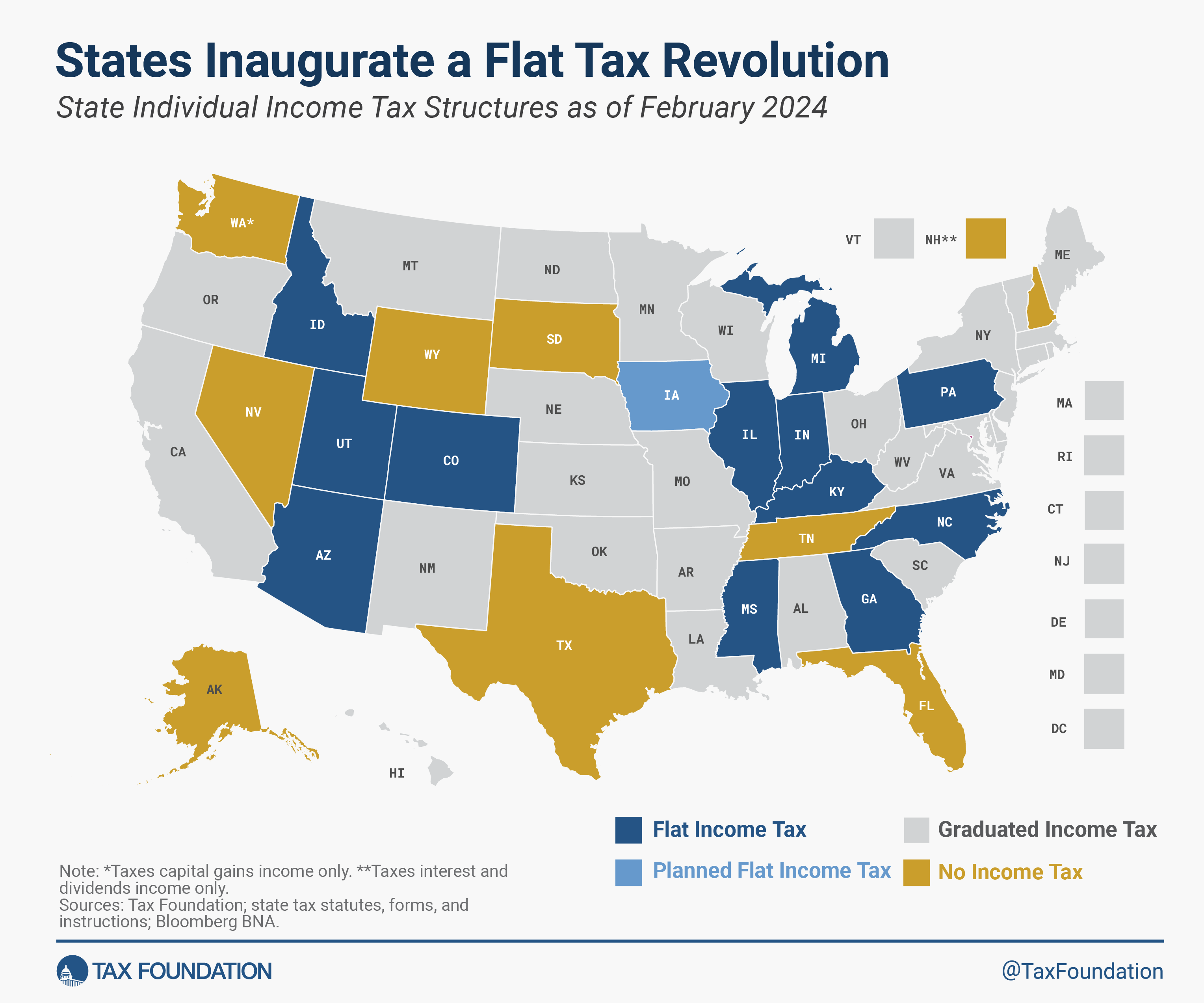

The future of American tax policy lies in balancing economic growth with equitable distribution. Proposals like the flat tax system aim to simplify taxation and enhance fairness. Additionally, reducing bureaucratic overhead and enhancing government efficiency are essential steps towards a more sustainable fiscal framework.

Conclusion

Understanding the intricacies of the American tax burden requires a comprehensive view of its historical roots, political dynamics, and international context. As taxpayers, it is essential to advocate for reforms that promote transparency, efficiency, and economic justice.

Contact Information

Syed Salman Mehdi

BS(IT), PGD Software, Current Affairs Expert

+923337011728

salmanmehdi128@gmail.com

Keywords: American tax burden, tax reform, fiscal policy, government efficiency, international tax comparison, war and taxation, economic impact

By Syed Salman Mehdi