The future of investment research

September 28th, 2023 | 22:15 | S2:E15

Episode Summary

Head of Investment Research Mary Pryshlak joins host Thomas Mucha to discuss the evolution of research in the asset management industry amid shifting market, technological, and geopolitical environments.

Episode Notes

Head of Investment Research Mary Pryshlak joins host Thomas Mucha to discuss the evolution of research in the asset management industry amid shifting market, technological, and geopolitical environments.

Key topics:

- 1:40 – Career as a global industry analyst

- 3:00 – Differentiated investment research

- 5:15 – How research is evolving

- 6:50 – Industry-specific investment processes

- 8:30 – Investment outlook

- 11:00 – How deglobalization impacts research

- 14:30 – Collaboration examples: AI and the banking crisis

- 17:10 – Filtering out the noise

- 18:45 – Personal observations

In the dynamic realm of asset management, the role of investment research is undergoing a profound transformation. As the financial markets respond to shifting global trends, technological innovations, and geopolitical developments, it is imperative for professionals in the industry to adapt and innovate. In this extensive exploration, we delve into the evolving landscape of investment research, its relevance, challenges, and opportunities, all through the lens of an industry expert, Mary Pryshlak, Head of Investment Research.

The Changing Face of Investment Research

Mary Pryshlak, a prominent figure in the asset management sector, provides a unique perspective on the trajectory of investment research. Her journey as a global industry analyst has equipped her with insights into the nuances of an ever-changing landscape. In this article, we aim to dissect the key topics discussed in her recent conversation with Thomas Mucha, highlighting the salient aspects of the industry's evolution.

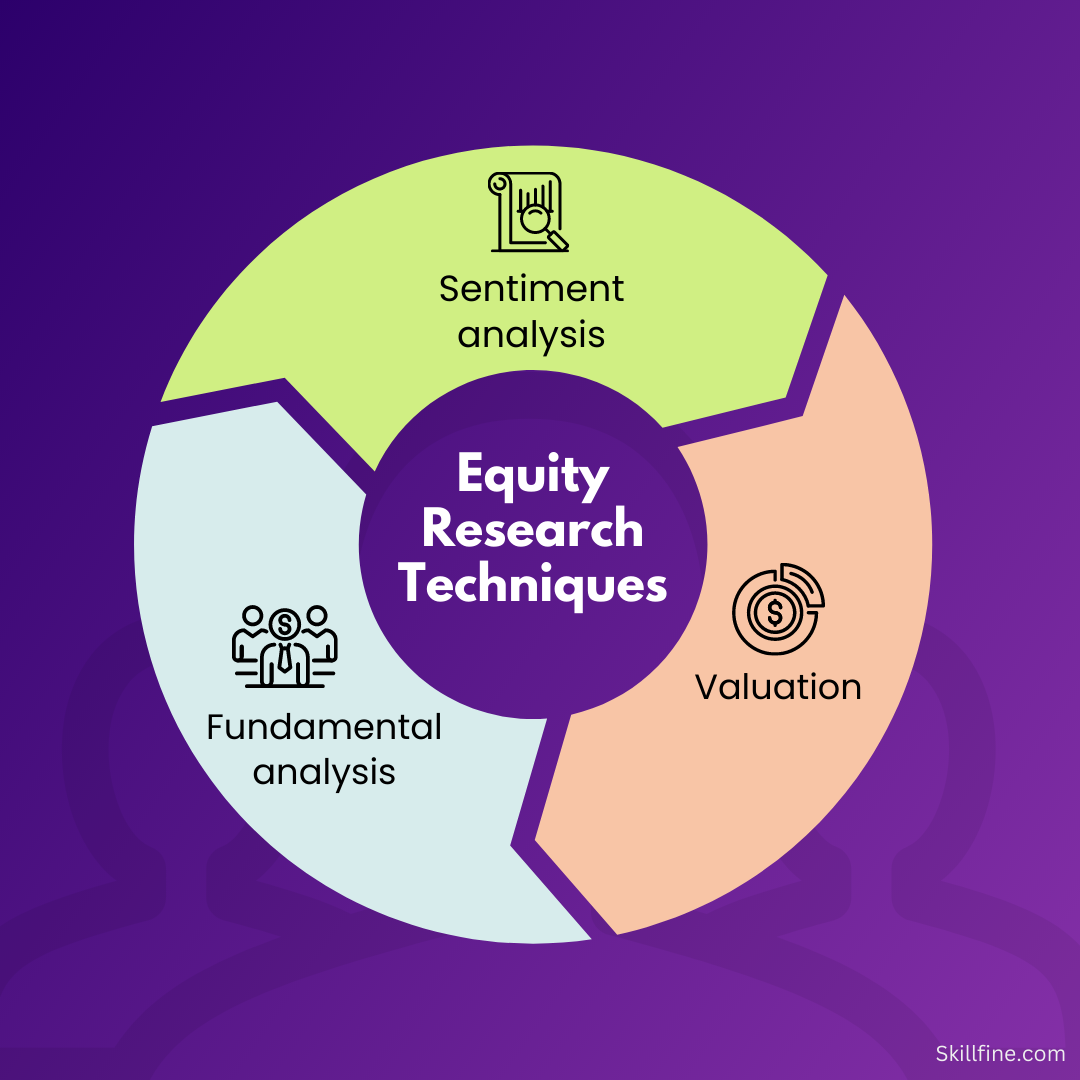

Differentiated Investment Research

One of the paramount aspects of investment research is differentiation. Mary Pryshlak emphasizes the need for research to stand out in a crowded field. In an age of information overload, investment professionals must find innovative ways to differentiate their research. This article explores various strategies and approaches to achieving this crucial distinction.

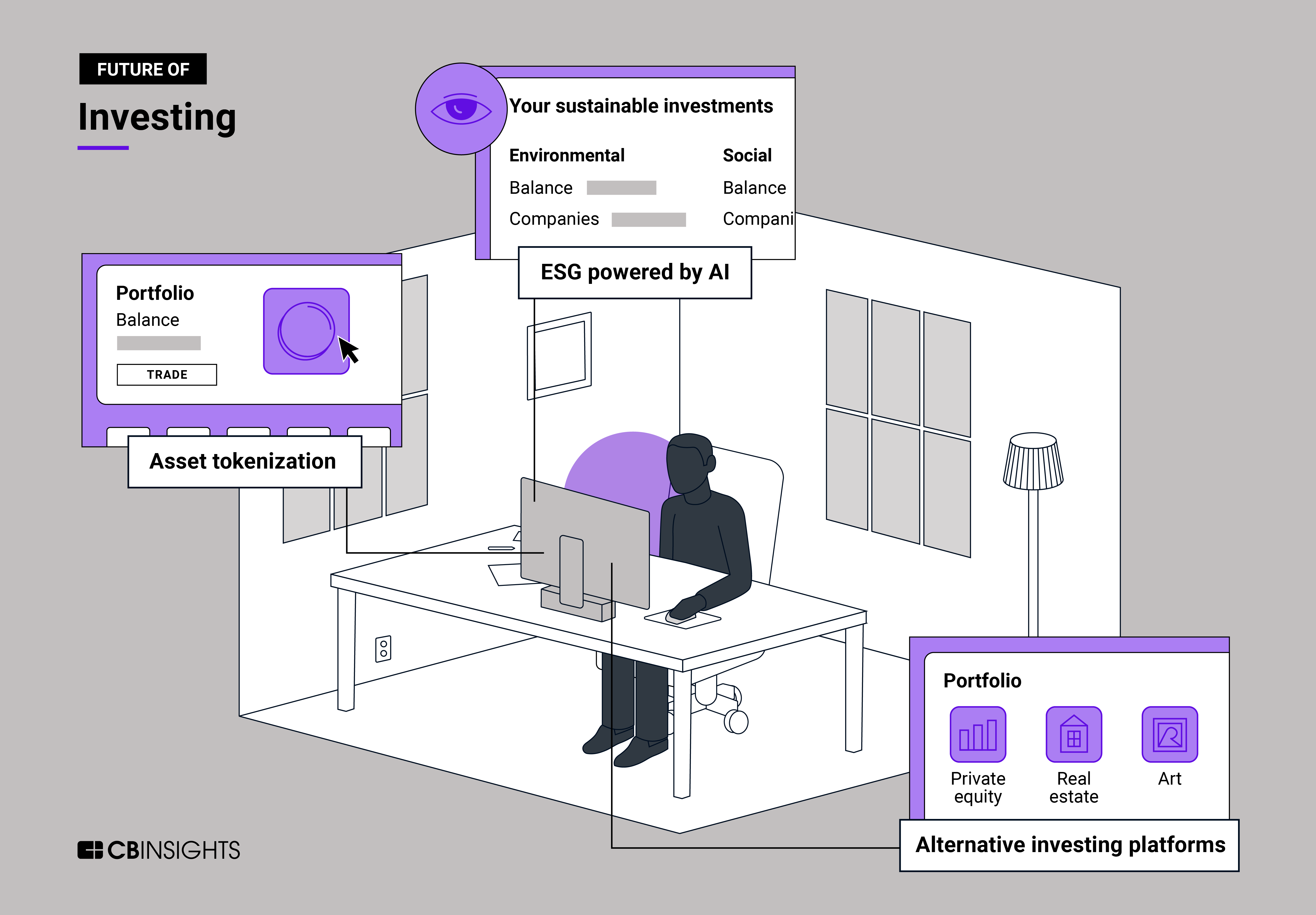

The Evolution of Research

Investment research, once primarily conducted through traditional means, is now witnessing a paradigm shift. The adoption of cutting-edge technologies and data analytics is redefining how research is carried out. We delve into the ways in which technology is transforming the research landscape and the implications it has on decision-making.

Industry-Specific Investment Processes

The investment landscape is far from one-size-fits-all. Different sectors and industries require tailored approaches to research. Mary Pryshlak discusses the importance of understanding the unique nuances of various sectors and how it influences the investment process. We elaborate on her insights and provide examples of how industry-specific research processes can lead to informed investment decisions.

Investment Outlook in a Changing World

In today's rapidly evolving world, predicting investment outcomes is a challenging task. We examine the factors that are currently shaping the investment outlook and explore the strategies used by professionals to navigate uncertainty and capitalize on opportunities.

The Impact of Deglobalization on Research

The recent trend of deglobalization has significant repercussions for investment research. As the world moves away from globalization, investment professionals must adapt their research methodologies to align with this new reality. Mary Pryshlak sheds light on how deglobalization impacts research and what it means for investors.

Collaboration Examples: AI and the Banking Crisis

In the era of collaboration, we explore instances where diverse sectors, such as artificial intelligence (AI) and finance, come together to address critical issues. Pryshlak discusses real-world examples of how collaboration has been instrumental in navigating challenges, such as the banking crisis. We provide a deep dive into these collaborations and their outcomes.

Filtering Out the Noise

In a world inundated with information, the ability to filter out irrelevant data and focus on what truly matters is a skill that every investment researcher must possess. This article examines the techniques and tools used to sift through the noise and extract valuable insights.

Personal Observations and Insights

Mary Pryshlak concludes the discussion with her personal observations and insights into the industry's future. We share her perspective on the state of investment research and her vision for what lies ahead.

In a world where the financial markets are continually shaped by a multitude of factors, investment research is the compass that guides asset managers through uncharted waters. As Mary Pryshlak and Thomas Mucha delve into the evolving landscape of investment research, this article serves as a comprehensive guide to the future of research in the asset management industry. With a focus on differentiation, technology, industry-specific processes, and collaboration, it provides invaluable insights for investment professionals seeking to thrive in an ever-changing environment. The world of investment research is in flux, and staying ahead of the curve is the key to success.